Tax and tax returns

Last updated: 27/3-2024

This text is about taxes and filing your tax return. The money you pay in taxes goes to the state, so that the state can pay benefits such as child benefit, housing allowance and sickness benefit. Tax revenue also pays for schools, medical care, the police and libraries.

This text explains how the Swedish tax system works. It also explains tax returns and how you go about filing your tax return.

Everyone is entitled to a job. This amounts to a right not to be excluded from the labour market. Where you are from, what gender you are or how old you are should not affect your chances of getting a job.

There are several rights that are linked to work. You are entitled, for example, to fair working conditions, to equal pay for equal work and to join a trade union. You are also entitled to rest and time off work.

It is also a right for parents to be able to combine family life with work. Children are entitled to protection from work that is harmful or hinders a child’s development and schooling.

What is tax?

Tax is a charge that pays for public expenses. We pay taxes on our income and on goods and services.

Taxes are a large and important source of income for a country. In Sweden, the money is used for medical care, schools, roads, public transport, libraries and many other things.

There are different types of taxes. One example is the tax you pay on your salary when you work. This is known as income tax. Income tax is automatically deducted from your salary before it is paid to you. So the money you receive in your account is what you have left to live on.

The Swedish income tax system is progressive, meaning that people who earn more money pay more in tax. We pay our income tax in the municipality and region where we live. Income tax rates differ between municipalities, but are usually somewhere between 29 and 35 per cent of your income. People who earn incomes over a certain level also pay tax to the state.

Tax returns

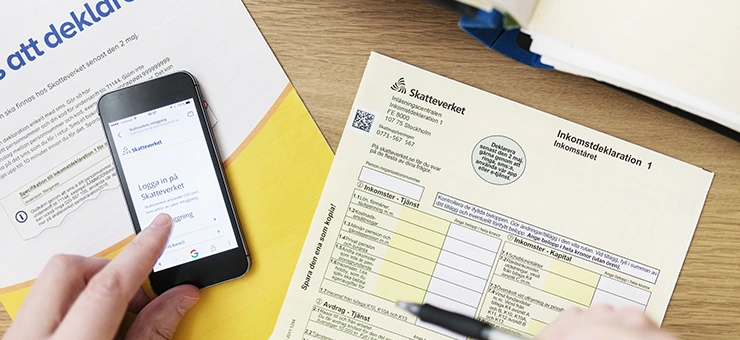

The Tax Agency (Skatteverket) is the government agency in Sweden responsible for ensuring that private individuals and companies pay taxes.

Every year, everyone who has earned money has to tell the Tax Agency about their earnings. This known as filing your tax return. It applies for private individuals as well as companies.

At the beginning of the year, the Tax Agency sends a tax return form to the person who has to file a tax return. The form says how much you earned during the past year. You have to check that the information is correct.

If the information is correct you have to approve the tax return. You can do that by sending a text message, phoning, or using the Tax Agency's app or the e-service on the Tax Agency's website. The e-service is only available in Swedish.

If the information in the tax return is incorrect you have to correct it. You can make changes to your tax return using the e-service on the Tax Agency's website. The e-service is only available in Swedish.

If you are unable to file your tax return by sending text message, phoning, or using the app or the e-service, you can file your tax return by filling in the paper form and posting it to the Tax Agency.

If you have not received a tax return form, you may nevertheless be obliged to file a tax return.

On the Tax Agency's website you can order a tax return form from the Tax Agency's ordering service. The ordering service is only available in Swedish.

If you have questions about your tax return, contact the Tax Agency. You can phone or email them or visit a service centre. Staff at the service centre can help you with various matters administered by the Tax Agency, Försäkringskassan and the Swedish Pensions Agency. They can give you guidance and advice and help you to fill in forms and make applications.